Understanding Bitcoin’s Recent Open Interest Wipeout

Bitcoin, the world’s leading cryptocurrency, recently witnessed a dramatic shift in its market dynamics. A staggering $12 billion in open interest was wiped out, sending shockwaves across the trading community. While such a large-scale liquidation may seem alarming, analysts argue that this event was not only necessary but also a crucial step in Bitcoin’s long-term bullish trend.

What is Open Interest in Bitcoin Trading?

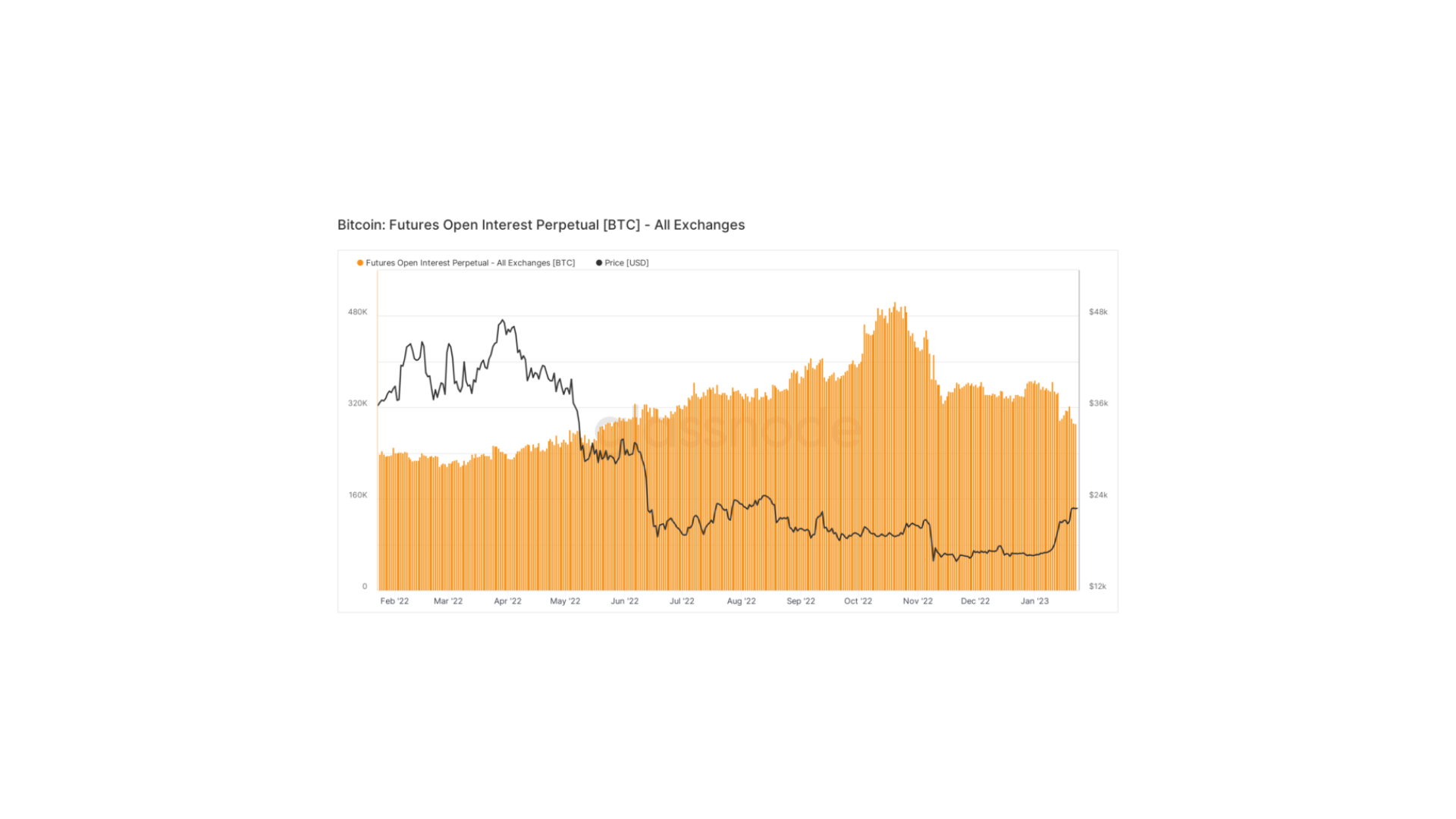

Before diving into why this wipeout was essential, it’s important to understand what open interest means. In simple terms, open interest refers to the total number of outstanding futures contracts in the market. It is a key metric that helps traders assess market sentiment and liquidity levels.

When open interest increases, it indicates more money is flowing into Bitcoin futures, suggesting strong trader engagement. Conversely, a decline in open interest means contracts are being closed, which can lead to increased price volatility.

Why Did Bitcoin’s Open Interest Drop by $12 Billion?

Several factors contributed to the massive reduction in Bitcoin’s open interest. Some of the key reasons include:

1. High Leverage Liquidations

Many traders in the Bitcoin futures market rely on leverage to amplify their positions. However, when prices move against their positions, forced liquidations occur, causing a chain reaction of sell-offs. This recent event saw billions in leveraged positions wiped out, leading to a significant drop in open interest.

2. Market Correction and Profit Booking

Bitcoin had experienced a strong upward rally before the wipeout, prompting many investors to book profits. This natural correction helped reset the market and remove excessive speculative interest, making the uptrend healthier in the long run.

3. Macroeconomic and Regulatory Factors

Global financial conditions and regulatory developments also played a role in Bitcoin’s market shake-up. Uncertainty regarding interest rates, inflation, and potential government regulations led to short-term panic selling, contributing to the decline in open interest.

Why This Wipeout Was Necessary for Bitcoin’s Bullish Trend

Despite the initial panic, many crypto analysts believe that this liquidation event was crucial for Bitcoin’s long-term growth. Here’s why:

1. Flushes Out Overleveraged Positions

Excessive leverage can create unsustainable price movements, making the market vulnerable to sudden crashes. The recent wipeout eliminated weak hands and overleveraged traders, paving the way for a more stable price structure.

2. Stronger Support Levels Established

With speculative positions reduced, Bitcoin can now build stronger support levels. This makes future rallies more sustainable, reducing the risk of sudden and extreme corrections.

3. Improved Market Health

A market that relies too heavily on leverage is fragile. The liquidation event helped reset trader sentiment, allowing Bitcoin to resume its bullish trend with a healthier foundation.

Analysts Remain Bullish on Bitcoin

Despite the short-term market turmoil, analysts remain optimistic about Bitcoin’s future. Many experts believe that this correction was a necessary phase before Bitcoin continues its upward journey. Historically, similar wipeouts have preceded major rallies, and the current scenario seems to follow the same pattern.

Key Indicators Supporting the Bullish Trend

- Rising Institutional Interest – Large financial institutions are still accumulating Bitcoin, indicating confidence in its long-term potential.

- On-Chain Data Remains Strong – Metrics such as active addresses and hash rate continue to show positive signs.

- Supply on Exchanges Declining – More Bitcoin is being moved off exchanges, suggesting investors are holding for the long term.

What’s Next for Bitcoin?

With the market stabilizing, traders and investors are now looking ahead. Some key points to watch include:

- Bitcoin’s ability to hold key support levels around $60,000–$62,000

- Potential catalysts such as ETF approvals and institutional adoption

- Macroeconomic trends that may influence Bitcoin’s price movement

Final Thoughts

While a $12 billion open interest wipeout may seem like a setback, it was a necessary step in Bitcoin’s ongoing bullish cycle. Market corrections help remove excess speculation, making future price movements more organic and sustainable. As history has shown, such events often act as a precursor to strong bullish rallies, reinforcing the belief that Bitcoin’s long-term growth trajectory remains intact.

For traders and investors, this serves as a reminder that volatility is a part of Bitcoin’s journey. Staying informed, managing risk, and adopting a long-term perspective remain the best strategies for navigating the crypto market.